Autochartist

Autochartist is a powerful market analysis tool with intuitive and easy-to-understand data charts. Its automatic trading reminder function, quality score and market report are popular among traders who are beginning to enter the market; advanced functions such as volatility analysis and price range prediction are also professional and essential tool for traders.

Product Demo is based on the past performance.

Free Technical Analysis

Technical analysis covering all markets from leading investment research providers.

Educational Videos

Foundation Courses

Animated Financial Courses

Economic Calendar

Market Trend

| Products | Bid | Ask | High | Low |

|---|

| EURUSD | 1.13350 | 1.13370 | 1.13435 |

1.13251

|

|

||||

| AUDUSD | 0.69462 | 0.69487 | 0.69519 |

0.69296

|

| USDJPY | 109.177 | 109.200 | 109.228 |

109.035

|

| GBPUSD | 1.25922 | 1.25943 | 1.26084 |

1.25821

|

| NZDUSD | 0.64676 | 0.64704 | 0.64780 |

0.64578

|

| USDCHF | 0.95588 | 0.95606 | 0.95604 |

0.95500

|

| USDCAD | 1.35008 | 1.35033 | 1.35121 |

1.34957

|

| EURCAD | 1.53038 | 1.53076 | 1.53167 |

1.52892

|

| EURCHF | 1.08351 | 1.08392 | 1.08361 |

1.08233

|

| EURGBP | 0.90002 | 0.90028 | 0.90035 |

0.89909

|

| EURJPY | 123.765 | 123.790 | 123.905 |

123.530

|

| EURNZD | 1.75211 | 1.75256 | 1.75485 |

1.74806

|

| AUDCHF | 0.66395 | 0.66433 | 0.66438 |

0.66208

|

| AUDCAD | 0.93785 | 0.93824 | 0.93856 |

0.93628

|

| EURAUD | 1.63149 | 1.63187 | 1.63552 |

1.62910

|

| GBPAUD | 1.81251 | 1.81288 | 1.81722 |

1.81065

|

| AUDJPY | 75.839 | 75.876 | 75.885 |

75.576

|

| AUDNZD | 1.07377 | 1.07412 | 1.07403 |

1.07192

|

| GBPCAD | 1.70019 | 1.70059 | 1.70220 |

1.69907

|

| GBPCHF | 1.20371 | 1.20409 | 1.20449 |

1.20219

|

| GBPJPY | 137.488 | 137.524 | 137.707 |

137.259

|

| GBPNZD | 1.94640 | 1.94710 | 1.95050 |

1.94280

|

| CADCHF | 0.70783 | 0.70822 | 0.70812 |

0.70687

|

| CADJPY | 80.849 | 80.888 | 80.904 |

80.691

|

| CHFJPY | 114.200 | 114.238 | 114.330 |

114.082

|

| NZDJPY | 70.612 | 70.656 | 70.677 |

70.449

|

| DXY | 96.395 | 96.455 | 96.450 |

96.340

|

| USDCNH | 7.10883 | 7.11146 | 7.11632 |

7.10601

|

| XAUUSD | - | - | - | - |

|

||||

| XAGUSD | - | - | - | - |

| COPPER | - | - | - | - |

News

Constantly updated throughout the day, the news section will keep you up-to-date with everything that is moving the markets and shaping trends.

Sign up

It’s free and easy to set up an account to trade FX and CFDs with us. You are just a few clicks away.

Sign up

Fill in our online

application form

Apply

Provide your IDs to

verify your account

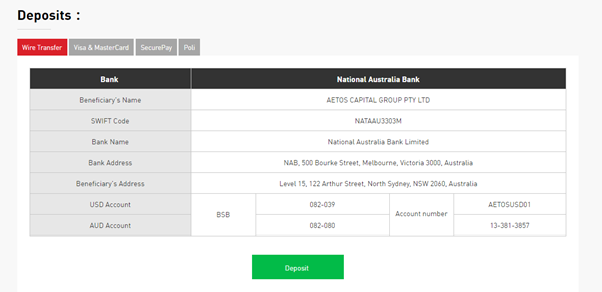

Fund

Fund to activate

account